NFT Collectibles: Redefining Ownership in the Digital World

In recent years, the world has witnessed a remarkable transformation in the concept of ownership, thanks to the advent of Non-Fungible Tokens (NFTs). NFTs, built on blockchain technology, have paved the way for the creation and trading of unique digital assets known as NFT collectibles. This article explores the fascinating realm of NFT collectibles, shedding light on their definition, market dynamics, investment potential, and future prospects.

Introduction to NFT Collectibles

What are NFTs?

NFTs are cryptographic tokens that represent ownership or proof of authenticity of a unique item or piece of content. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, each NFT is distinct and cannot be replicated or exchanged equivalently.

Emergence of NFT Collectibles

The concept of NFT collectibles gained prominence with the rise of blockchain technology, particularly Ethereum’s implementation of the ERC-721 standard, which enabled the creation and trading of unique digital assets on the blockchain.

Understanding NFT Collectibles

Definition and Characteristics

NFT collectibles encompass a wide range of digital assets, including artwork, virtual real estate, domain names, gaming items, collectible cards, and more. What sets NFT collectibles apart is their indivisible nature, immutability, and provable ownership recorded on the blockchain.

Types of NFT Collectibles

NFT collectibles can be broadly categorized into various types, including digital art, virtual goods, sports memorabilia, music, videos, and other forms of digital content. Each type holds unique value and appeal to different segments of collectors and investors.

The Rise of NFT Collectibles Market

Historical Background

The origins of NFT collectibles can be traced back to the early experiments with digital scarcity and cryptographic tokens. However, the market witnessed explosive growth and mainstream adoption in the mid-2010s, fueled by the success of early NFT projects and the growing interest in blockchain technology.

Recent Trends and Developments

In recent years, the NFT collectibles market has experienced unprecedented growth, driven by high-profile sales, celebrity endorsements, and increased participation from artists, creators, and collectors worldwide. The emergence of specialized NFT marketplaces and platforms has further facilitated the buying, selling, and trading of NFT collectibles.

Popular NFT Collectibles

Artwork and Digital Assets

One of the most prominent categories of NFT collectibles is digital artwork, including paintings, illustrations, animations, and generative art. Artists and creators are leveraging NFTs to tokenize their creations, establish provenance, and monetize their work in the digital realm.

Gaming and Virtual Assets

The gaming industry has embraced NFTs as a means of tokenizing in-game assets, such as characters, skins, weapons, and virtual real estate. NFT collectibles offer players true ownership and interoperability across different gaming platforms, enhancing the gaming experience and creating new economic opportunities.

Sports Memorabilia and Trading Cards

NFTs have also disrupted the sports memorabilia market, allowing fans to collect and trade digital representations of iconic moments, player cards, and exclusive merchandise. Sports leagues and organizations are exploring NFTs as a novel way to engage with fans and create new revenue streams.

Investing in NFT Collectibles

Factors to Consider

While investing in NFT collectibles can be lucrative, it’s essential to conduct thorough research and consider various factors, including the rarity, demand, provenance, and authenticity of the collectible. Understanding the underlying technology and market dynamics is crucial for making informed investment decisions.

Risks and Benefits

Like any investment, NFT collectibles carry inherent risks, including market volatility, regulatory uncertainty, and potential fraud or counterfeit items. However, for savvy investors, NFT collectibles offer the potential for significant returns, diversification, and exposure to emerging trends in the digital economy.

Creating and Selling NFT Collectibles

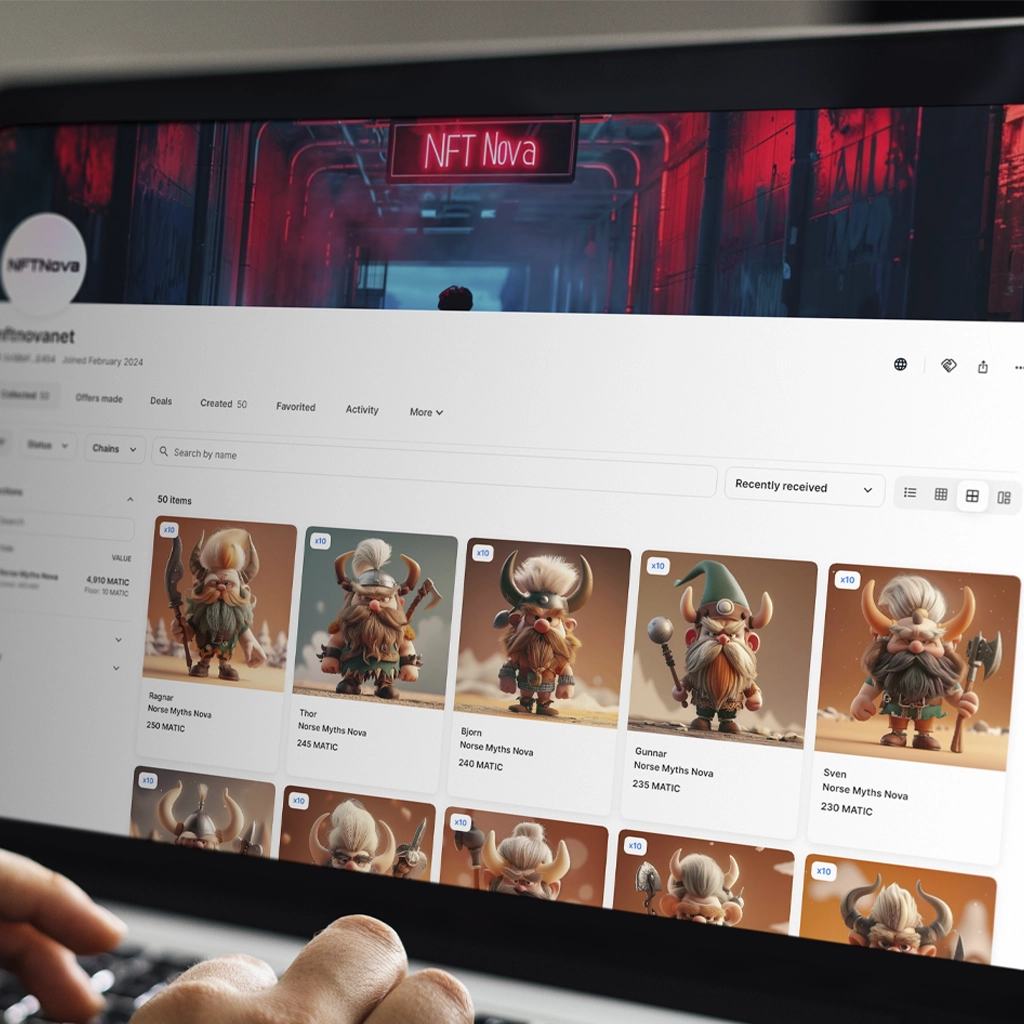

Platforms and Marketplaces

There are numerous platforms and marketplaces dedicated to NFT collectibles, each offering unique features, services, and communities. From industry-leading platforms like OpenSea and Rarible to niche marketplaces catering to specific categories or demographics, creators and collectors have a plethora of options to choose from.

Process and Guidelines

Creating and selling NFT collectibles typically involves minting tokens, defining metadata, setting pricing and royalties, and listing the items on compatible marketplaces. It’s essential for creators to familiarize themselves with the technical aspects of NFT creation and adhere to best practices to maximize the visibility and value of their collectibles.

Legal and Ethical Considerations

Copyright and Ownership

The intersection of NFTs and intellectual property rights raises complex legal issues concerning copyright, licensing, and ownership. Creators and buyers must understand the legal implications of creating, selling, and owning NFT collectibles, especially when dealing with copyrighted content or derivative works.

Environmental Impact

The energy consumption associated with blockchain networks, particularly Proof of Work (PoW) consensus mechanisms, has sparked concerns about the environmental sustainability of NFTs. It’s essential for stakeholders to explore alternative solutions and mitigate the carbon footprint of NFT transactions through innovations in blockchain technology and eco-friendly practices.

Future Outlook of NFT Collectibles

Potential Growth and Challenges

Despite the exponential growth of the NFT collectibles market, challenges remain, including scalability issues, regulatory scrutiny, and market saturation. However, the continued adoption of blockchain technology, advancements in digital art and gaming, and the evolution of NFT standards hold promise for sustained growth and innovation in the future.

Innovations and Opportunities

Looking ahead, the future of NFT collectibles is ripe with possibilities, from virtual reality experiences and augmented reality integrations to decentralized autonomous organizations (DAOs) and programmable royalties. Innovators and entrepreneurs are exploring novel use cases and business models that leverage NFTs to revolutionize various industries and redefine ownership in the digital age.

Conclusion

In conclusion, NFT collectibles represent a paradigm shift in the way we perceive and interact with digital assets, offering unprecedented opportunities for creators, collectors, investors, and enthusiasts alike. By harnessing the power of blockchain technology, NFTs have unlocked new forms of creativity, ownership, and value exchange, ushering in a new era of digital ownership and cultural expression.

FAQs

What makes NFT collectibles unique?

NFT collectibles are unique digital assets authenticated on the blockchain, enabling true ownership, provenance tracking, and scarcity in the digital realm.

How can I start collecting NFTs?

To start collecting NFTs, you can create an account on a reputable NFT marketplace, browse listings, and purchase tokens using cryptocurrency.

Are NFT collectibles a good investment?

While NFT collectibles can be a lucrative investment, it’s essential to conduct thorough research and consider factors such as rarity, demand, and market trends before investing.

What are some legal considerations when dealing with NFTs?

Legal considerations when dealing with NFTs include copyright infringement, licensing agreements, intellectual property rights, and compliance with regulations governing digital assets.

How do NFTs impact the environment?

The energy consumption associated with NFT transactions, particularly on Ethereum’s blockchain, has raised concerns about the environmental impact of NFTs. However, efforts are underway to explore eco-friendly alternatives and mitigate the carbon footprint of blockchain networks.